In the exhilarating game of Monopoly, the wealthiest players often have the knack for discovering shortcuts to amass wealth and bypass fees. In real life, the game is strikingly similar for some of the world’s billionaires.

This piece features seven billionaires who, through legal and intricate maneuvering, have significantly benefited from tax loopholes. Get ready to delve into a labyrinth of complex tax codes and uncover how these billionaires play the real-life game of Monopoly.

Larry Ellison

Ellison, the co-founder of Oracle Corporation, with a net worth of over $90 billion, is no stranger to using tax loopholes. With a complex web of trusts and real estate investments across the globe, Ellison has reduced his taxable income significantly. Instead of being a mere beneficiary of tax loopholes, Ellison has leveraged them as strategic financial tools, sparking conversations about wealth inequality and the need for reform in the tax system.

But let’s not overlook the fact that he’s also a philanthropist, contributing to numerous charitable causes. It’s a curious paradox, isn’t it? A billionaire uses tax loopholes to maintain wealth while giving back to society. It’s a tale as old as time and a revealing glimpse into the complexities of economic inequality.

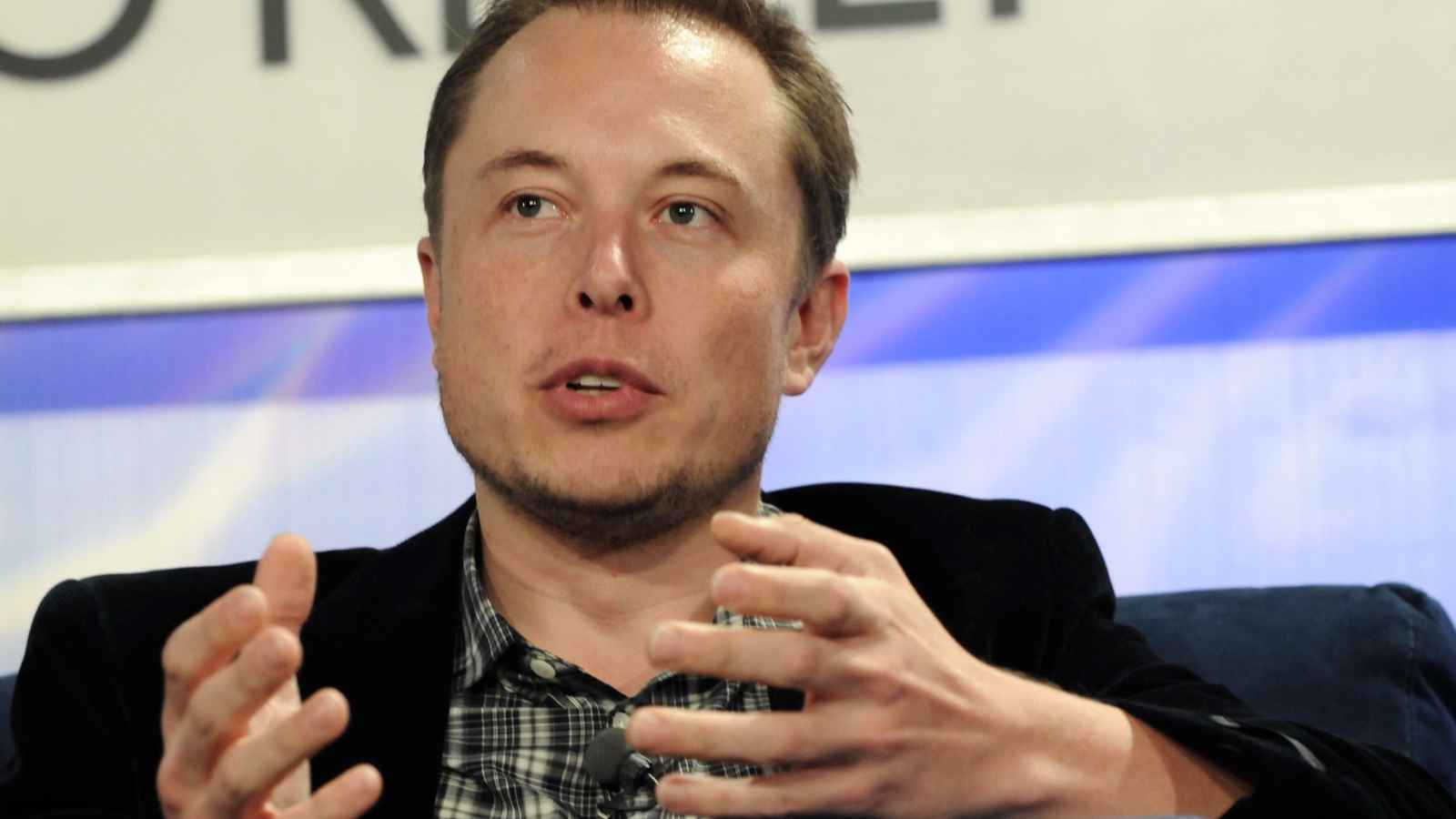

Elon Musk

Elon Musk, the innovative mastermind behind SpaceX and Tesla, is known for his remarkable ability to disrupt industries and various tax advantages. Musk’s Tesla, for instance, has taken advantage of numerous tax credits promoting green energy. While beneficial for promoting sustainable energy, these subsidies have also exponentially increased his wealth.

This loophole raises questions about societal inequity on the uneven distribution of these financial benefits across the socioeconomic spectrum, a point often overlooked in the narrative of Musk’s success.

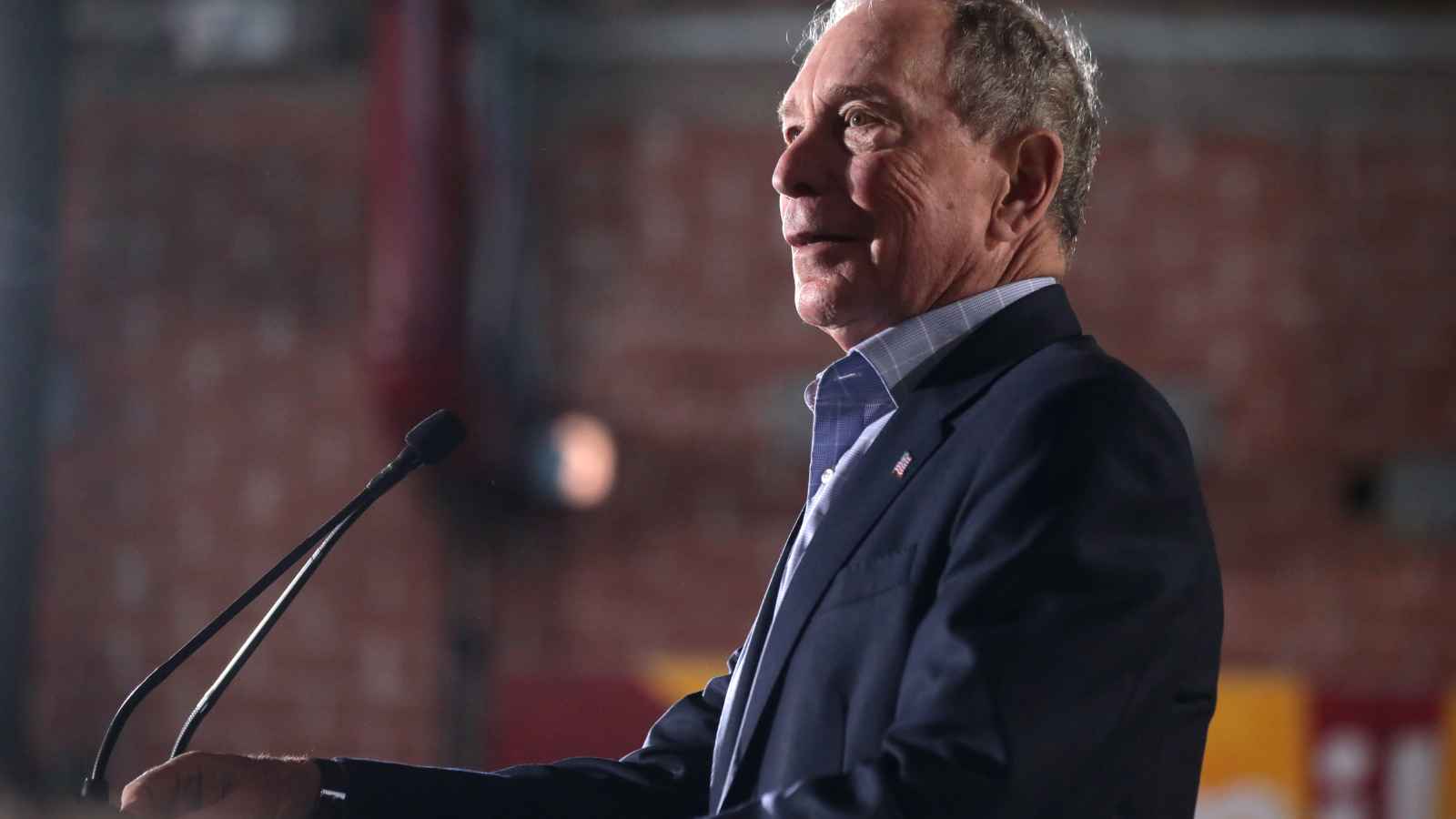

Michael Bloomberg

The media mogul, Mike Bloomberg, showcases a different edge of the tax loophole spectrum. Despite amassing a fortune exceeding $50 billion through his eponymous news and data company, Bloomberg LP, his effective tax rate has been astonishingly low.

Strategic philanthropy has allowed Bloomberg to enjoy significant tax deductions, with charitable deductions to his foundation, often in the form of appreciated securities, and exploiting gaps in estate tax laws, offsetting his taxable income. But one has to wonder, at what cost does this come to the rest of society?

George Soros

George Soros, renowned for his immense wealth and philanthropic pursuits, also capitalized on tax loopholes. Born in Hungary, Soros, the “Man Who Broke the Bank of England,” has an estimated net worth of $8.6 billion. Despite being known for his generous donations to progressive causes, Soros has a complex web of offshore entities, which allows him to reduce his tax liabilities.

His wealth accumulation is a tale of expert financial maneuvering, exploiting tax loopholes, and deferring taxes on his hedge fund profits. This exploitation of tax loopholes shines a light on the inequality entrenched in our economic system, as wealth continues to concentrate in the hands of those who can navigate these fiscal intricacies.

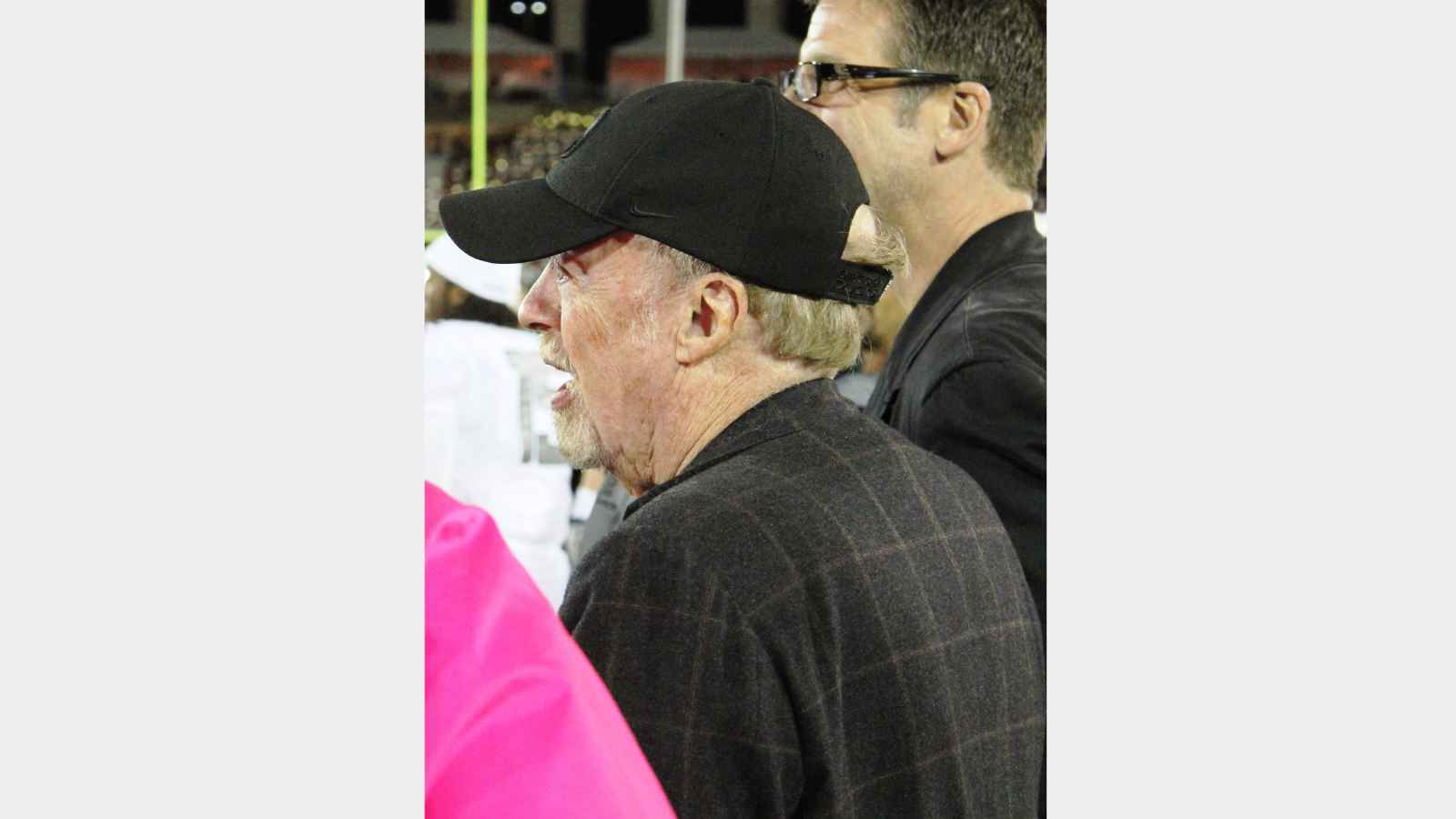

Philip Knight

Philip Knight, the co-founder of the sportswear giant Nike, has built a vast fortune leveraging not just his business acumen but also the intricate labyrinth of tax loopholes. With an estimated net worth that runs in the billions, Knight has reduced his tax liability to almost negligible levels.

This was made possible by a series of tax incentives, deductions, and crafty offshore structures, all perfectly legal yet controversial. While his shoes may symbolize athletic prowess and style around the globe, his financial maneuvers are a stark reminder of the profound wealth inequality pervasive in today’s society.

Warren Buffett

Warren Buffett, the oracle of Omaha, is revered for his investment prowess and equally famous for his frugality. Despite being the fourth-wealthiest person in the world, Buffett has relatively simple tastes. He still resides in the house he bought in 1958, and loves a good deal.

Interestingly, Buffett, a vocal advocate for higher taxes on the wealthy, has benefited from tax loopholes. Berkshire Hathaway, Warren’s company, uses “deferred taxes” — taxes accrued but not immediately paid — to lower its corporate tax bill. This savvy use of tax loopholes has contributed significantly to his colossal net worth.

Jeff Bezos

Jeff Bezos is not just known for his innovative thinking and business acumen that propelled Amazon to its towering heights. His knack for navigating the wild world of taxes is equally intriguing. As the world’s former richest man, Bezos has exploited the existing tax system, with his wealth ballooning even amidst controversies.

The most glaring example? In 2007, despite raking in billions, he paid zero federal income tax, thanks to exploiting legal tax loopholes like deductions and credits. It’s a testament to how our tax system desperately needs an overhaul to level the playing field.

Sources:

The New York Times: Where Did Billionaires’ Billions Go?

CNBC: The Wealthy May Avoid $163 Billion in Taxes Every Year. Here’s How They Do It

The New York Times: Wealthiest Executives Paid Little to Nothing in Federal Income Taxes, Report Says

The Billionaire Tax Uproar: 11 Arguments For and Against Wealth Redistribution

Wealth redistribution has been a hot-button issue for years, with people on both sides fervently defending their positions. On one side are those who believe that the wealthy should pay more taxes to help fund social programs and support those in need. On the other side are those who argue that taxation is an unfair form of punishment and takes away from individuals’ hard-earned money.

The Billionaire Tax Uproar: 11 Arguments For and Against Wealth Redistribution

The Ultimate Guide to the Best Luggage Sets in 2024

When it comes to choosing the best luggage set to buy, there are a lot of factors you need to consider. For example, what type of traveler are you? How often do you travel? What is your budget? Do you need a hardshell or softshell suitcase? These are just some of the questions you must ask yourself before purchasing the best luggage sets. In this ultimate guide, we will help make the process a little bit easier for you.

The Ultimate Guide to the Best Luggage Sets in 2024

25 Richest Families in America

Americans are enthralled with watching the lifestyles of the rich and famous unfold on TV and social media. Despite the extravagant cars and vacations showcased on certain programming franchises, the wealth of these celebrities pales in comparison to some of America’s richest families.

25 Richest Families in America

10 Renowned Philanthropists With Controversial Past

The world of philanthropy is often considered the realm of the selfless and compassionate, a place where individuals dedicate their resources to improve the lives of others. Yet, even within this sphere of benevolence exists an undercurrent of controversy.

10 Renowned Philanthropists With Controversial Past

How to Invest $1000 in the Stock Market

If you’re interested in investing your money in the stock market, you’ve probably found several articles and information online. However, it can be overwhelming, especially if you’re new to the process. The key is to know where to start. For example, you can buy fractional shares of stock, or you can invest through an IRA. You may also be interested in learning about 529 plans and Vanguard ETFs.

How to Invest $1000 in the Stock Market